The government recently announced further funding for a second wave of the Mutuals Support Programme, which “offers support to both aspiring and growing Public Service Mutuals”.

The official definition of a Public Service Mutual is an organisation that has left the public sector (also known as ‘spin outs’), continues to deliver public services and aims to have a positive impact, whilst also allowing “a significant degree of staff influence or control in the way it is run”. The coalition government began actively encouraging this model back in 2010, with the basic notion being that whole service sections of public sector organisations begin to operate as independent businesses, selling their services back to that organisation and into further markets.

With the current government reportedly particularly interested in the creation of new mutuals in children’s services, health, adult social care and culture & leisure services, we used Porge’s Public Sector Market Insight tool, Illuminator, to take a closer look at how three such companies – Catalyst Choices CIC, Greenwich Leisure Limited (GLL) and City Healthcare Partnership CIC – are getting on:

Catalyst Choices CIC

Porge client Catalyst Choices launched as an independent CIC on 1st February 2015 after ‘spinning out’ of Warrington Borough Council. Illuminator shows that Catalyst are the Council’s largest provider of Health & Social Care services and, with North West England’s regional spend in this market having grown by £780M in two years, the company looks well-placed to achieve its aim to “develop, strengthen and continuously improve”.

Greenwich Leisure Limited (GLL)

Founded in 1993 as an alternative way for Greenwich Council’s leisure services to be run in reaction to funding cuts, it took just three years for GLL to start providing services outside of the borough. By the end of Feb 2018, Illuminator shows that 13 local authorities were spending over 50% of their total Culture & Leisure outlay with the organisation, with GLL bucking the wider trend seen in this market by improving on its 2016/17 performance.

City Healthcare Partnership CIC

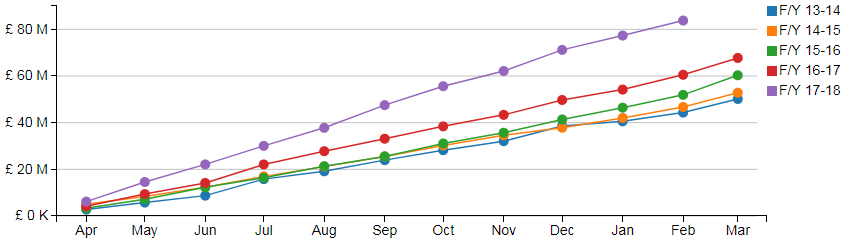

This Hull-based independent health service provider recently celebrated eight years since it ‘spun out’ of the local NHS and now employs over 2000 people, with all shares owned by colleagues. With the company describing itself as “flourishing, innovative and forward-thinking”, the chart below shows how spend with the organisation has grown over the last five years:

Illuminator gives a real-time market view based on the analysis of actual invoices paid by over 1000 public sector bodies. Porge’s database contains over 90 million categorised invoices, providing the most accurate and up-to-date source of public sector spend data available.

So if you need to know what’s really happening in the public sector, talk to us about our fact based Public Sector Market Insight Services.

To view the original Porge article please visit: http://www.porge.co.uk/blog/2018/06/public-service-mutuals-how-are-they-doing

Recent Comments